Cup Loan Program – A Complete Guide, How to Apply, Legit, Requirements: Cup Loan Program is designed to provide financial assistance for the construction, renovation, or purchase of critical community facilities in rural areas. You are in the right place if you are looking for a better way to finance your public facility project. Don’t worry; we’ll find the best solution for you. If you need something affordable, reliable, and easy to apply for,? If so, the Cup loan program is the best option for you.

I’ve found a fantastic opportunity ideal for anyone who wants to improve their local communities. In short, it’s a helping hand from the USDA, providing low-interest loans.

Institutions that require financing for construction or repair projects. Its significant projects include constructing schools or renovating smaller towns’ hospitals. It will be discovered that the Cup loan program provides substantial financial benefits, including low-interest rates and flexible payback. These terms make it cost-effective for customers. You will find all the required information about this program in this article.

The straightforward application process for understanding the various loan possibilities. That’s why we developed a cup loan program. Consider it. This article explains everything you need to know about this loan program. It includes how it works, the benefits, eligibility requirements, and interest rates. Stay with us,

. What is the Cup Loan Program?

Cup loan program offered by the United States Department of Agriculture (USDA). This loan provides the public with the facility to construct and renovate a home. Facilities included in this loan are schools, libraries, homes, fire stations, and police stations.

The main objective of this initiative is to improve rural economies, leading to a better life. These community centers benefit from this loan scheme by receiving speedy funding for development and repair needs. Another benefit of this loan program is that it is available in almost every state in America.

Cup loans offer cheaper interest rates and more flexible terms than commercial lending programs. The basic program attempts to boost the US economy in rural areas with a population of 20,000 or less. It improves the quality of life.

All the states in the USA provide this loan. This loan program is also known as the Community Use of Public Facilities (CUPF). This program is especially used to provide facilities for rural areas.

So what does the Cup Loan Program do? This program is perfectly designed for public facilities. These facilities include construction, renovation, or any improvements you need. It means you can now easily access the best loan option to make your dream come true.

The cup loan program is an excellent source for public facilities. If you have a school loan, you can renovate your classrooms, libraries, and science labs. Libraries can get this loan to increase the reading space and collection.

Homes use loans for home decor, buy home accessories, and houses for homeless people.it is also used to fulfill basic needs. Police Stations, through this facility, increase the department’s jobs and upgrade the equipment. And solve the issue of society.

Hospitals use loans to enhance their facilities and upgrade their medical equipment. The fire station can use this loan to upgrade its equipment and expand its facilities. Community centers can also get this loan to increase their space and get other benefits.

Cup loans offer cheaper interest rates and more flexible terms than commercial lending programs. The basic program attempts to boost the US economy in rural areas with a population of 20,000 or less. And improve the quality of life.

Overview of the USDA CUP Loan Program

The following table offers complete information regarding the Cup Loan Program 2024. Multiple reasons make it a perfect loan program.

| Program Name | Cup Loan Program |

|---|---|

| Country | USA |

| Who is eligible for the Cup loan program? | American citizens, who are 18+ |

| Department Name | USDA |

| Loan Payment | $10,000 to $25 million |

| Interest Rates | 2.125% to 3.375% |

| Application fee | Nothing |

| Repayment Time | 30 Years |

| Loan Purpose | Financially Support Public Facilities |

| Application process | Simple |

| Public Reviews | Always Positive |

Cup Loan Program Interest Rate 2024?

Are you worried about the loan interest rate? You will be very happy to know that the Cup loan program offers a very low interest rate. This is a more favorable loan than a commercial loan. Fixed interest rates are available under the Cap Loan Program 2024, providing stability throughout the loan.

The interest is 2.125% to 3.375%, depending on the cost of borrowing money from the US Government. This rate varies according to your loan length. Once you get the loan the interest amount will be fixed. This program offers early payment choices and various terms of up to 30 years, customized to the duration of your project.

There are choices for annual or semi-annual payback periods, making them flexible. Borrowers have the option to pay interest entirely. During construction, it holds payments until the project is finished. After construction, you can make level or graduated payments to fit your financial situation.

Cup Loan Program Eligibility Criteria

What are the eligibility criteria to get this loan? Borrowers first understand the eligibility criteria and determine whether they are eligible before applying for a CUP loan. Below, I describe the eligible criteria:

Who is Eligible for the Public Facility Borrowers?

Here is a list of a few examples of eligible public facility borrowers:

- Fire Protection Districts

- School Districts.

- Library Districts.

- Hospital Districts

- Housing authorities

- Water and sewerage Districts.

- Recreation Districts

- Community development corporations

- Healthcare centers

- Senior Centers

How to Cup loan Program work?

This loan program works by providing low-interest rates to the public. Online lenders, financial technology businesses, and microfinance institutions offer cup loans for their needy customers. This loan program is better suited for small-business owners. These public facilities are owned and operated by the government cup loan program and non-profit organizations. You can use this loan for:

- construct a new facility or increase the area of the existing one

- repairing or designing

- extending land or upgrading equipment

- refine your existing

- debt for facilities

The repayment of this loan depends on your facility’s useful life. You can repay this loan in 40 years. The most important note is that the interest is fixed. This interest rate is based on the market rate when it is approved. You can get loans from this platform to cover your money-based needs. Here, you can apply for a loan with just a few documents.

Features of the Cup Loans Program

1. Small loan amounts

The Cup Loans program allows you to obtain a loan ranging from $10 to $500. However, this loan is based on your creditworthiness.

2. Short Tenure

Cup loans have a short repayment period, which might range from a few days to a few months. This allows borrowers to return the loan quickly and avoid paying excessive interest rates.

3. Easy Application Process

The cup loans platform enables you to simply obtain a loan using the website or mobile app. This site offers an easier application process than other lending platforms.

4. Minimal documentation

When you take out a loan from a bank, you must provide a large number of documents; however, if you use this platform, you will only need a few.

5. Quick disbursement

The cup loan employees ensure that you obtain money immediately. Some accept you to transfer funds to your account within a few hours.

6. No Collateral Required

To get a loan through the Program, you do not need to have substantial assets such as a car or a house.

7. Credit Score Flexibility

The credit score has little effect on the Cup loan platform. This allows you to obtain a loan even if you have a low credit score.

Percentage of Cup Loan Program

The average interest rate (APR) for these loans is around 150%, which is significantly lower than the conventional payday lending rates of more than 400%. Sometimes you can discover rates as low as 30%.

This Program’s interest rates may depend on a variety of factors:

- Market circumstances and fund accessibility.

- It also relies on the project’s type and scale.

- The financial stability and ability of your company to repay the loan.

- The Security or collateral is provided for the loan.

Who managed this program?

USAD’s Rule Development Agency manages this program. This agency works with local authorities to deliver the loans. This agency also provides technical assistance and total guidance about loans.

Who can get this loan?

So, what are the main benefits? Is this loan specific to public facilities? Nope, anybody can get this loan for the public facilities. No matter the size or location. If you are eligible for this loan, you can get it.

Cup Loan Program Requirements

Suppose you plan to take out a loan from this platform. So you must meet certain loan standards. If you wish to borrow, you must fulfill the requirement to be eligible for a cup loan program. Let’s get to the point.

Documents Required for the Cup Loan Program

- Identification documents.

- Provide proof of residential address.

- A valid passport (or) a driving license.

- Bank statement.

- Provide proof of income.

- Stable source of income.

- Credit History

Cup loan program complete review

Why should you choose this loan program? There are plenty of reasons. No. 1, you can get this loan with a low interest rate. No. 2, you have more than 30 years to repay this loan. No. 3: You can use this loan for various public facilities.

There are some essential points to consider before you apply.

Key Benefits of the Cup Loan Program

This program provides loans for public facilities. The Cup Loan Program offers many benefits that are extremely beneficial for borrowers. These benefits include construction, renovation, and improvement. So, in this loan program, there are no limitations on your project. Your project includes home construction, hospital, school, or whatever you are interested in.

- Low-Interest Rates: When compared to commercial bank loans, the cup loan offers relatively low-interest rates to its users.Such as commercial lenders and guaranteed landers.

- Simple Process. very easy and simple application process to apply for this loan. You can simply apply online or via email.

- Long-term Payback Time: The repayment period is more than 30 years. You can save a lot of money by using this service. Another significant advantage is the long-term payback time loans based on borrowers’ income flows.

- Flexible Terms: Borrowers’ terms are extremely flexible. You can use these funds for public services. There is no objection to your project. Funds can be used for renovation, construction, and improvement. Customers can customize the plan to their own needs, including the amount, duration, and time frame.

- No Penalties: if you paid all the amount before the deadline without any penalties. The interest rate on this program is typically lower than others. Such as commercial landers and guaranteed landers.

- Easy Application Process: The application procedure is simple. Borrowers can submit all necessary documents within 20 minutes.

- Application Fee: There is no need to pay any application fees to get a loan.

- Easy Terms and Conditions. The cup loan program allows the user to manage their loan according to their preferences. Eligible people can choose such things as frequency, repayment method, and amount.

- No Income Limitation is required. Eligible people do not need to meet any income limitations to apply for this loan.

- Customer Support and Service: The program provides technical support for borrowing. A supporting team can assist them with the application. Borrowers can get any assistance they require throughout the application process.

Overall, it appears that the Cup Loan program prioritizes accessibility, flexibility, and affordability for its clients. It makes it an interesting alternative for those who require financial support for their business.

Risks Associated with Cup Loan Programs

While Cup Loans have various advantages, they also include specific risks that customers should be aware of:

- High-interest rates:

Some Cup Loan programs may have greater interest rates than standard loans, which increases the entire cost of borrowing.

- Default consequences:

Failure to repay a Cup Loan on time can result in serious consequences, such as penalties, legal action, and damage to the credit score.

- Effect on credit score:

Failure on a Cup Loan or making late payments can lower your credit score, which makes it difficult to qualify for future loans or credit cards.

Range of Loan Amount

The maximum range you can get is $10 million; this is a substantial amount. This loan amount can go a long way toward funding your project. It is important to note that your loan amount depends on the size and specification of your project. So when you pass some specific steps to get the loan amount, you can get the loan amount.

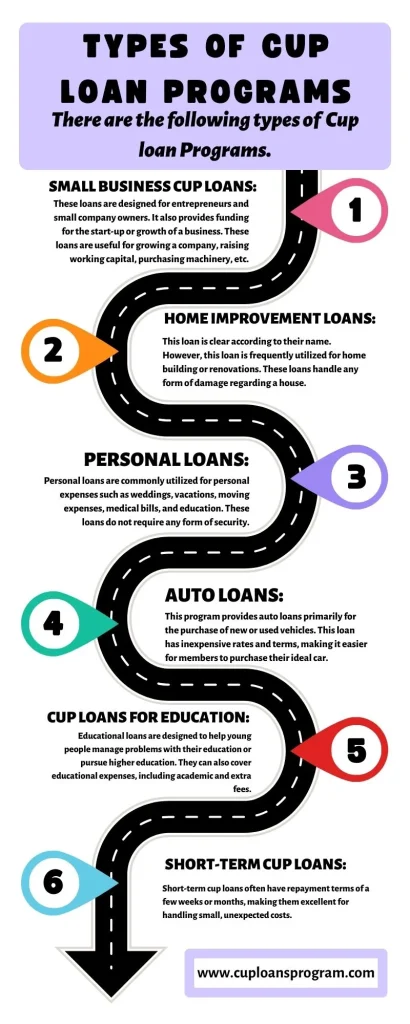

Types of Cup Loan Programs Available

Cup loans are divided into multiple types, each with its own set of advantages. Let me guide you about some different types of loan applications and how they can be used or fulfill financial needs.

Terms and Conditions about the Interest Rate and Repayment

The most significant benefit of this program is its low-interest rate. You can enjoy these rates, which are below the commercial rates. If you are willing to get a loan, you can save a lot of money. and the repayment period is more than 30 years.

It’s important to note that your interest and repayment depend on the type of loan. such as the direct loan, which is lower than the guaranteed loan. Both types of loans provide compatible terms and conditions. This will help you manage your facilities more conveniently.

the people who are willing to finance their projects more easily. So the Cup loan program is an attractive option for them. This program provides you with a better rural infrastructure option. With a low interest rate and a reasonable repayment period, this is the best option for you. Terms and conditions of interest rate depend upon some factors.

- Condition of the market and fund availability

- How much repayment ability of your organization’s

- security and collateral offer.

Generally, this program offers a much lower interest rate than others. cup loan program privacy policy and security terms and conditions are very favorable.

Who is eligible for the Cup Loan Program?

The people who meet the criteria listed below can easily apply for this loan.

Before applying for a Cup loan program, borrowers must understand the eligibility conditions and determine whether they are eligible or not. So I describe the eligible requirements below.

Eligible public facility borrowers, for example

How to Apply for the Cup Loan Program (Step-by-Step Guidance) Application Procedures:

Please read carefully about the cup loan program online application process before applying. Here is a step-by-step guide for applying to this program. The application process for the Cup Loan Program is so simple. The first step is to go to the USDA Rural Development’s official website.

The local USDA rural development office and speak with a loan expert. Their team will guide you if you are eligible for this loan. They will help you through the application process. You can also find out about the local office by visiting the cup loan program website. (USD Rural Development)

- Visit the Cup loan program Website:

Here’s the webpage link: https://www.rd.usda.gov/.

Choose the loan type that you want from the following link: https://www.rd.usda.gov/programs-services/all-programs

- For Homes

Buy, build, repair, or refinance your home.

Build or manage multi-family homes.

Find an apartment to rent in your region.

- For Businesses

Start or grow your business or cooperative.

Reduce your business’s climate impact.

Help businesses start and grow.

- For communities.

Develop a community economic plan.

Expand/improve community facilities & services.

Build out or upgrade water treatment facilities.

- Download the Cup Loan Application Form.

For example, you pick a home loan from the Cup loan official website link: https://www.rd.usda.gov/

- Then you’ll be taken to a separate page to download the application form.

- Fill out the form with your details and any necessary documents.

- Ensure that the documents provided are correct.

- Prepare the Necessary Documents.

Every loan is the same. Only a few supporting documents will be different. The cup loan requires the following documents:

- Legal documents. Articles of incorporation, Bylaws, and Resolutions

- Financial statements. Income, Balance, and Cash Flow Statements.

- Feasibility study or business plan.

- Application and Selection Form for Home Loans.

- Personal Identification, Financial Statement, Environmental Statement.

- USDA Rural Development Office Application.

- Environmental Assessment or Impact Statement

- Engineering Report or Architectural Design

- Submitted your application.

After completing the application, submit it online or in person at the USDA Rural Development office. The online and offline methods are similar; you require the same documents. The final step of this application is to submit all the related and required documents that help you verify your eligibility and feasibility report for your project.

- Review and Eligibility.

After submitting the form, the cup loan program USDA Rural Development staff will assess your application. If you are eligible for the Cup Loan Program, they will notify you by email, and you will need to review the terms and conditions after confirming the policies. When you complete the application and submit the related documents. The USDA reviewed your application and decided whether you were eligible or not. If you qualify for the loan, you will receive a confirmation letter outlining the terms and conditions.

- Receive funds.

Once you have confirmed the policies, the actual funds will be transferred to your bank account.

Loan Approval:

After applying for cup loan program, you must wait to find out if it has been accepted. After a particular period, you will receive an approval letter for the application. When your loan application is granted, they will give you an approval letter with all of the necessary terms and conditions.

Analyzing the letter is important for learning about their rules and regulations, practices as well as your project and repayment schedule. Cup loan USDA loan procedures and terms are fairly straightforward, with no hidden policies.

Review these policies carefully and seek clarification on anything you don’t understand” The Cup loan p aims to provide eligible borrowers with a speedy approval process, appropriate interest rates, and flexible repayment options. You can contact the experts so that they can guide you to complete the application procedure more smoothly.

Loan Disbursement

So, the final phase is here! After approving the loan, the financier will send the funds to the chosen bank account that you mentioned while accepting the loan’s terms.

This ensures that funds are transferred securely and swiftly, allowing borrowers to use them as soon as possible.

The timetable for payout may vary depending on the loan’s complexity and amount, but the Cup Loan is dedicated to guaranteeing a timely process.

Now, as the applicant, you have to guarantee that the loan funds are spent by the terms and conditions that had been decided upon.

Is the Cup Loan Program Legit?

The USDA (United States Department of Agriculture) offers the Cup Loan Program, which is government-based. This program mainly aims to provide small, short-term loans to eligible customers. This lending program is created in such a way that it can help a large number of eligible customers without any inconvenience. It increases flexibility and makes it easier to apply.

Scammers typically target those persons in need of urgent, short-term loans. After that, they approach these borrowers via social media or email, on behalf of the Cup Loan Program. Once the borrower agrees to proceed with the application process, these scammers collect hundreds of dollars as an upfront fee as well as personal information such as name, address, bank details, social security number, and so on to extract additional funds from the borrower using misconduct such as identity theft.

After receiving all of the information and initial fees, these scammers will block you from anywhere and will never respond to you. The victims receive no loan or money back, leaving them exposed to preserve their identities. As a result, you must exercise caution while responding to emails or messages received via your social media platforms. Never give your personal information online if you have any doubts, You can double-check by reporting it to the Federal Trade Commission (FTC).

Is the CUP Loan Program Real or Fake?

The Cup Loan Program scheme, created by the United States government, is a certified legit money lending scheme. As a result, you no longer have to be concerned about being scammed and can proceed with confidence through the process.

Overall, the Cup Loan program USDA provides a simple solution to all financial difficulties. As discussed in this article, the program has various advantages, including a simple application procedure, low interest rates, and flexible repayment options.

You may make an informed selection by knowing cup loans, including their benefits and potential drawbacks. I believe you now have accurate knowledge of the Cup Loan because we thoroughly covered everything. So it’s critical to examine any program before applying and let me walk you through how to recognize and avoid Cup Loan Program Scams.

What are the Signs of Cup Loan Program Fraud Cases?

If you do not want to fall victim to a scammer, here are a few warning indicators to look for before responding to such suspicious texts or emails promoting the Cup Loan Program.

Comparison of the Cup Loan Program 2024 with other Loan Programs

| Features | Program | The USDA Rural Development Community Facilities Direct Loan Program | The HUD Section 108 Loan Guarantee Program |

|---|---|---|---|

| Projects targeted | Public facilities such as schools, libraries, and community centers | Specific public facilities like healthcare and public safety facilities | Infrastructure improvements and real estate projects are examples of economic development projects |

| Focus Area | Available for a wide range of areas | Focused on rural area projects | Projects primarily located in urban areas |

| Interest Rates | .125% to 3.375% in 2024) | Low-interest rates | Higher than Cup Loan Program |

| Repayment Terms | Up to 40 years flexible | Long repayment period | variable |

| Program Accessibility | The eligibility criteria are broad | Restricted to specific types of facilities | The focus is on economic development rather than public facilities |

| Ideal For | Various public facility projects in different areas | Projects for public facilities in rural areas | Urban economic development projects |

Why Choose the Cup Loan Program?

Borrowers choose the Cup Loan Program for borrowing because of its easy application process and quick disbursement of funds making the loan an easy option for borrowers to meet their urgent financial needs. There is no burden of long loans.

Borrowers can quickly repay the loans since they come with short repayment periods, without worrying about long-term commitments.

Cup Loan Program Reviews

The Cup Loan program is suitable if you are a small company owner in a rural area that are searching for cash for a public facility project. This financing program offers loans for public facilities’ development and renovation. The Cup Loan Program includes very low interest rates and flexible terms for repayment. It is easy to apply and is approved within 24 hours.

Case Study 1: “I had a wonderful experience with the Cup Loan Program. After completing the application, I received the funds within two days. The flexible repayment options and cheap interest rates enabled me to effectively handle my finances”. Mr. Smith

Case Study 2:

“Sarah, a single mother, required money for car maintenance after a sudden breakdown. With no savings and insufficient credit. She chose a cup loan program. She was able to receive the money she needed promptly. Allowing her to resume her work and travel without delay”.Miss Sarah

Case Study 3:

John, a small business owner, wants the money to buy products for an upcoming sale but doesn’t do this for the lack of funds. He applied for a cup loan and was accepted within hours, allowing him to take the opportunity to boost his profits” Mr. John.

Plus American Savings Cup Loan Program

The Plus American Savings of Cup Loan Program was established by the US Department of Education and is administered by Plus American Savings. This program allows you to use Plus Loans to pay for educational expenditures. It allows borrowers to use Plus Loans to cover the costs of attending institutions such as colleges or universities. These loans are federally funded and are accessible to parents of department undergraduate, graduate, or professional students.

Pros and Cons of Cup loan Program

Pros

Cons

Conclusion

The CUP loan program is an excellent way to finance public facility projects in rural communities. It provides low-interest loans with variable terms and conditions, allowing you to improve the quality of life and economic development in your town. Its low-interest rates and flexible conditions make it a desirable option for those who may struggle to obtain finance through regular channels.

The program’s goal is to enhance the standard of life and economic growth in rural regions around the United States by providing critical public services and infrastructure. If you want to apply for a CUP loan or learn more about it, go to the USDA Rural Development website or visit your local USDA Rural Development office.

It is critical to carefully understand the cup loan program rules and guidelines to verify that you meet the eligibility requirements. Before applying for a loan, you should check all the terms and conditions carefully.

Overall, the Cup Loan Program is an excellent resource for public facilities in rural areas. It needs financing for construction and renovation initiatives. By taking advantage of this opportunity, you may contribute to the growth and progress of your town. While ensuring that important public services are accessible to anyone who requires them.