A Complete Guide on the DSCR Loan Program

What Does Mean by DSCR?

A Complete Guide on DSCR Loan Program: This article outlines the updated process of the DSCR Loan Program. We have collected and organized data from official sources to present it in a tailored format for easy understanding.

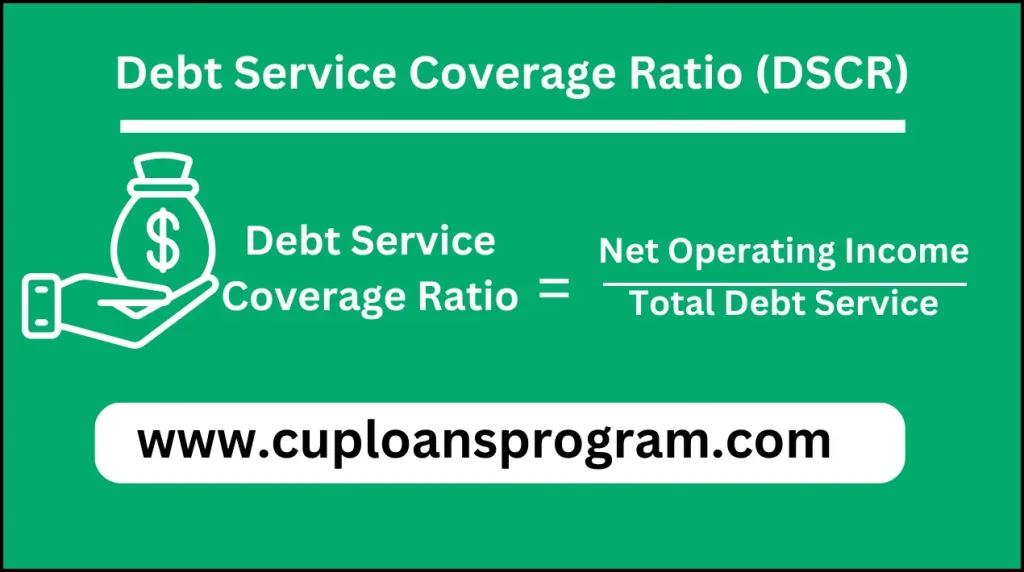

DSCR stands for Debt Service Coverage Ratio It is a financial metric used to assess a company’s ability to meet its debt obligations such as principal and interest payments on loans. Simply put, it determines how easily a company can meet its current debt payments with its cash flow.

There are two main users of DSCR:

- Lender:

Banks and other lenders use the DSCR to decide whether to lend to a business. becomes a more attractive lender.

- Investors:

Investors use DSCR to assess any company’s financial health and their debt capability, it only shows a strong DSCR that the company is financially stable and its own Can handle the debt burden effectively.

Here’s how DSCR is calculated:

DSCR = Net Operating Income / Debt Service

- Net operating income (NOI) represents a company’s cash flow from its core operations.

- Principal repayments and interest payments on all of the company’s loans are included in the debt service.

A higher DSCR will improve a company’s debt coverage. Still, there is no ideal DSCR ratio here as it may vary in terms of industry and the company’s specific circumstances. The one-to-one ratio can raise concerns about paying the company’s debt.

What is the DSCR Loan Program?

A DSCR (loan service coverage ratio), or investor cash flow, is a mortgage for real estate investors. Unlike the traditional mortgage, it is a property instead of your agony. Enables borrowing based on expected cash flow.

Here is how it works:

Focus on Cash flow

Instead of revenue verification and tax declarations, DSCR relies on loan rental income, which is expected for property.

Calculate the DSCR

Lenders calculate the debt service coverage ratio (DSCR) to assess the property’s capacity to meet the mortgage payment. This proportion is the property’s monthly rent income divided by the monthly mortgage payment. A normal minimum requirement is 1.1X DSCR, i.e., the payment of the rent mortgage must be 10 % higher.

Loan without QM

DSCR loans are considered non-qualifying mortgages (non-QM). They are for lenders who cannot meet traditional loan requirements.

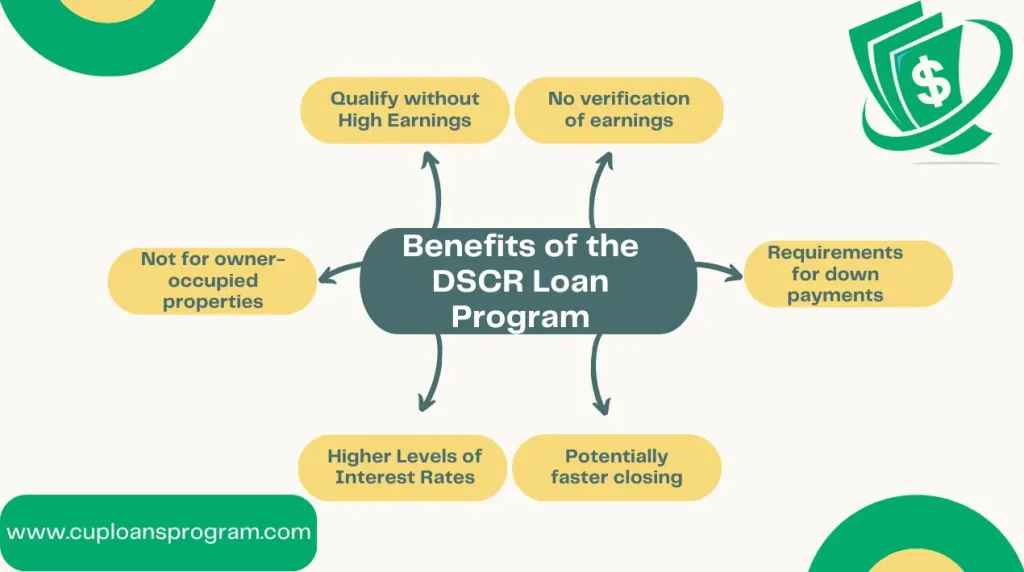

Benefits of the DSCR Loan Program

Qualify without High Earnings

If your income is too low for a traditional loan, a DSCR loan can still be an option if the investment property has a strong projected cash flow.

No verification of earnings

With DSCR loans, you can avoid the difficulties of filing taxes and proving your income.

Potentially faster closing

Due to simpler documentation requirements, DSCR loans may have quicker closing times than conventional mortgages.

Here are some benefits of DSCR loans:

Higher Levels of Interest Rates

DSCR loans often have higher interest rates than conventional loans due to the perceived higher risk.

Requirements for down payments

Even while DSCR loans might not care about your income, they might demand a bigger down payment.

Not for owner-occupied properties

DSCR loans are not intended for homes you intend to occupy yourself; rather, they are for investment properties that will be rented out.

The DSCR Loan can be a viable choice for real estate investors looking to finance an investment property, particularly if their income does not satisfy the conventional loan standards. Before making a choice, it’s crucial to consider the advantages and disadvantages and evaluate the rates offered by various lenders.

Pros and Cons of DSCR Loans

Pros

Cons

Conclusion

In conclusion, DSCR loans are valuable for real estate investors who want to finance properties based on their potential rather than personal income. These loans have advantages, such as faster closings and no income verification. However, they also have drawbacks, such as higher interest rates and larger down payments. DSCR loans can be a useful tool for investors. However, it is essential to carefully consider the advantages and disadvantages and compare lenders before deciding.