Dscr Loan Pros and Cons

Introduction

Dscr Loan Pros and Cons: In the dynamic world of finance, understanding the intricacies of different loan choices is critical to making an informed decision. A prominent example of such a financial instrument is the Debt Service Coverage Ratio (DSCR) loan. In this post, we’ll examine the benefits and drawbacks of DSCR loans, offering insightful information for investors and companies.

What Is A DSCR Loan?

The Debt Service Coverage Ratio (DSCR) loan is frequently used in company and real estate financing. It gauges a company’s or property’s capacity to pay off debt, including principal and interest payments.

DSCR Loan

30-year fixed rate DSCR loan for stabilized rental properties

| Interest Rate | from 7.5 | Term | 30-yr fixed rate |

| Origination fee | 2-3% | Maximum Loan Amount | $150,000 |

| Loan To Purchase Prices up to | 80% | Maximum Loan Amount | $3,000,000 |

| Loan To Value up to | 80% | Minimum FICO | 660 |

| Minimum DSCR | None | Type of Property | Residential 1-4 units |

Dscr Loan Pros and Cons

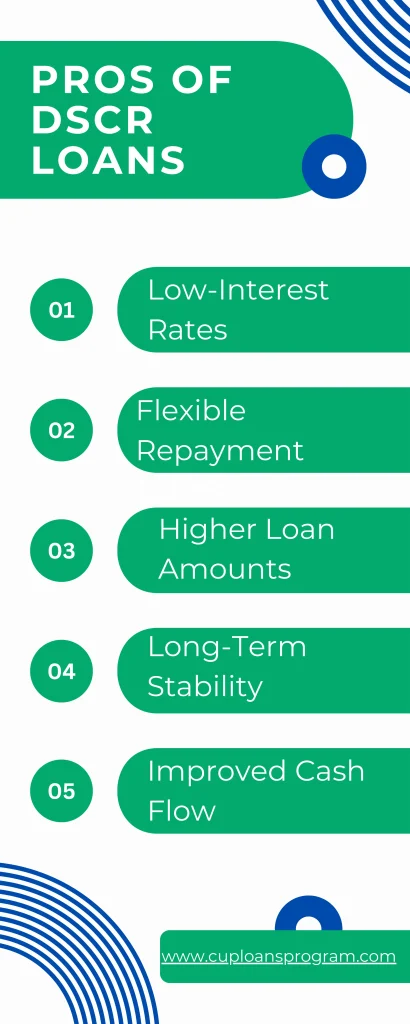

The Pros of DSCR Loan

Low-Interest Rates

DSCR loans frequently have low interest rates, making them a desirable choice for those who want to reduce their borrowing expenses.

Flexible Repayment Terms

A personalized approach to loan repayment is possible for borrowers by allowing them to bargain for variable payback terms based on their cash flow.

Higher Loan Amounts

DSCR Loan: Larger loan sums are sometimes available to enterprises by enabling significant investments and expansions.

Long-Term Stability

For borrowers, the consistency of DSCR loans, particularly in long-term projects, provides a sense of financial security.

Improved Cash Flow

DSCR loans emphasize the property’s earning potential, enhancing cash flow and promoting financial stability.

The Cons of DSCR Loan

Strict Eligibility Criteria

Borrowers may need to exhibit a solid financial position and consistent cash flow to meet the strict eligibility requirements for DSCR loans.

Risk of Property Seizure

Lenders have the right to confiscate the financed property in the event of failure, putting borrowers in grave danger.

Market Dependency

Due to the influence of market conditions, the success of enterprises that rely on DSCR loans is uncertain.

Potentially Higher Initial Costs

Compared to other financing options, DSCR loans may have more outstanding upfront fees despite the significant long-term benefits.

Variable Interest Rates

Variable interest rates on some DSCR loans may cause monthly payments to be unpredictable.

When To Consider A DSCR Loans

Investments In Real Estate

DSCR loans are perfect for real estate endeavors since they offer the funding required to purchase and develop real estate.

Growing the Business

DSCR loans provide a solid financial foundation to assist growth initiatives for companies looking to expand.

Capital Expenditures

With DSCR loans, financing significant capital expenditures becomes easier to manage and guarantees efficient corporate operations.

How do I qualify for a DSCR loan?

Cash Flow Demonstration

A strong cash flow statement is essential to demonstrate the company’s capacity to pay down debt quickly.

Creditworthiness

Keeping your credit score high increases your chances of getting a good-term DSCR loan.

Requirements For Collateral

To protect the lender in the event of a default, collateral may be needed to secure the loan.

Understanding Debt Service Coverage Ratio (DSCR)

Calculation Explanation

One way to compute DSCR is to divide the total debt service by the net operating income. Positive cash flow is indicated by a ratio greater than 1.

Ideal DSCR Ratio

Lenders often view a DSCR ratio of 1.25 or greater as desirable, though requirements may differ.

Case Studies: Successful DSCR Loan Applications

The success stories of companies who deliberately used DSCR loans to meet their financial objectives are demonstrated by real-world examples. These case studies offer insightful information on the difficulties encountered and overcome throughout the loan application procedure.

Navigating The DSCR Loan Application Process

Requirements For The Documentation

Borrowers must prepare complete documentation, such as predictions, business plans, and financial accounts.

Choice Of The Right Lender

It’s important to choose a lender with experience in DSCR financing. Look around and evaluate lenders to see which is ideal for your company.

Key Considerations

Before agreeing to a DSCR loan, consider the loan conditions, interest rates, and repayment plans.

Tips on How to Mitigate The Risks Associated with DSCR Loans

Thorough Analysis Of the Market

Carrying out an exhaustive market analysis makes it easier to identify possible dangers and modify the loan plan accordingly.

Contingency Planning

A solid contingency plan helps companies prepare for unanticipated events that could impact their cash flow.

Professional Advice Financial

Consulting with financial specialists guarantees that companies make knowledgeable choices about DSCR loans.

Comparison With Other Types Of Loans

DSCR Versus Traditional Mortgages

Compare and contrast DSCR loans with conventional mortgages, emphasizing the benefits and drawbacks of each.

DSCR Versus Personal Loans

This is a comparative analysis of DSCR loans and personal loans, clarifying the circumstances in which each might be more appropriate.

DSCR Versus Equity Financing

We examine the distinctions between equity financing and DSCR loans and the commercial ramifications.

Conclusion

In conclusion, knowing the advantages and disadvantages of DSCR loans is critical for investors and companies looking for financial stability and expansion. By carefully balancing the benefits and drawbacks, people can make well-informed decisions that support their financial objectives.