Crediterium Loan Reviews: An In-Depth Review

Crediterium Loan Reviews: Are you struggling with a financial problem or looking for a personal loan to help you in an emergency? Here’s a loan program called Crediterium Loan.

In this blog article, we will discuss Crediterium Loan, including what it is, how it works, its pros and cons, its features, and more. After reading this blog article, you will be able to decide if this is right for you. So let’s dive in.

What is a Criterium Loan?

Crediterium is an online lender based in California. They offer personal loans online. The loans are provided by Crediterium LLC, a finance and technology company.

They make borrowing easy. Apply for a loan on their website and choose from different options.

Crediterium Loans Features:

| Competitive Interest Rates: | Crediterium loans have interest rates from 6%. |

| Loan Amount: | You can get a loan of up to $100,000 if you qualify. |

| Flexible Repayment Terms: | The program offers flexible repayment terms of 12 to 60 months. This suits people with a steady income. |

| No Prepayment Penalty: | You can repay the loan early without extra charges or fees. |

| Fast Funding: | You can get the money in your bank account the next day. |

| Referral Program: | The program includes a referral scheme. If you like the program, you can tell your friends about it. Earn $100 for each successful referral. |

| Flexible Loan Usage: | Creditor loans can be used for personal purposes. You can use the loan for anything. |

Crediterium Loan Requirements:

To get a Crediterium Loan, you usually need to:

How to Apply for a Criterium Loan?

To apply for a Crediterium Loan, follow these steps:

Crediterium Loan Phone Number

Obtaining a personal loan can be daunting. Our experts are always available to help with your application.

We can help with any questions you have about our loans, applications, or existing loans. Our customer service team is here to help you with any questions or issues you may have.

At Criterium, we help you achieve your financial goals and live your best life. Contact us today for a Crediterium difference!

Phone: +1 (844) 4CRDTRM / +1 (844) 427-3876

[email protected]

Suite 503-B, 3105 NW 107 Ave, Doral, FL 33172, United States

Business Hours

| Monday | 8:00 AM Central | 6:00 PM Central |

| Tuesday | 8:00 AM Central | 6:00 PM Central |

| Wednesday | 8:00 AM Central | 6:00 PM Central |

| Thursday | 8:00 AM Central | 6:00 PM Central |

| Friday | 8:00 AM Central | 6:00 PM Central |

| Saturday | 8:00 AM Central | 6:00 PM Central |

| Sunday | Closed | 6:00 PM Central |

Crediterium Loan Reviews

Positive Reviews:

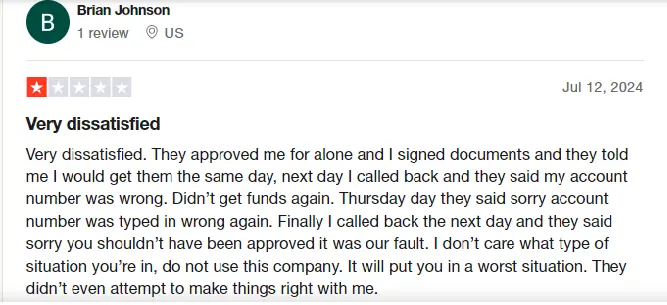

Negative Reviews:

Additional Tips for Borrowers

Here are some tips for Crediterium Loan borrowers.

Compare Rates:

Compare rates and fees from different lenders to find the best option.

Know the terms:

Understand the loan terms and any extra fees.

Boost Your Credit:

Improve your credit score to get better loan terms.

Look at other options:

Look at other loans, like personal loans from banks or credit unions.

Read Reviews:

Read reviews to see if Crediterium Loan is right for you.

Conclusion:

Crediterium’s microfinance loans help people in marginalized communities to access finance. The platform’s commitment to education, transparency, and community building helps it succeed.

Microfinance lending has risks, but it has a positive impact on people and communities. Think carefully about the pros and cons before making any financial decision.