Debt Service Coverage Ratio (DSCR)

Debt Service Coverage Ratio (DSCR): When you borrow money, whether to buy a home, start a business, or invest in real estate, you must repay it over time. This repayment comprises the amount borrowed (known as the principal) and the additional fee for borrowing the money (known as interest). Lenders want to ensure that you can afford to repay what you owe, so they calculate it using a metric called the debt-service coverage ratio (DSCR).

What is the Debt Service Coverage Ratio?

The debt-service coverage ratio, or DSCR for short, is similar to a financial health check. It assists lenders in determining whether you have sufficient income to meet your loan installments. Essentially, it indicates whether you earn enough money to comfortably repay what you owe, including principal and interest.

“It helps assess your ability to fund future expansion and is frequently utilized by bankers and investors to comprehend a company’s creditworthiness and prospects.”

How is the DSCR calculated?

The DSCR is calculated by considering two major factors: income and debt payments. Here’s an easy way to grasp it:

Imagine you own a lemonade stand. You sell lemonade for $1 per cup and earn $50 daily. That is your income. Suppose you borrowed $20 to purchase a nice lemon squeezer for your stand. Every day, you must repay $2 (the $1 borrowed plus an additional $1). That is your debt payment.

To calculate your DSCR, divide your income by your debt payments. In this case, your DSCR would be 50 (income) divided by $2 (debt payment), which is 25. This means you earn 25 times more money than you have to repay every day. That is good!

In reality, however, things can be more tricky. Instead of a lemonade stand, you may own an apartment complex or a corporation. Instead of making a single debt payment, you may be required to repay loans for the purchase of the property, repairs, or other expenses. However, the core premise remains the same: DSCR determines if your income is sufficient to support your debt payments.

What Does the DSCR Tell Us?

The DSCR helps lenders determine how likely you are to repay your loan. Here’s what various DSCR numbers could mean:

DSCR of one or more indicates that your income is sufficient to cover your debt payments. The greater the number, the better, as it indicates that you have more money coming in than out. Lenders prefer a DSCR of at least 1.2, which suggests you earn 20% more than your debt payments. It offers them confidence that they can handle their debts comfortably.

DSCR less than 1:

If your DSCR is less than one, your debt payments exceed your income. This can be a red signal for lenders because it indicates that you may struggle to keep up with payments. In this instance, lenders may be unwilling to give you money or provide less attractive loan terms, such as higher interest rates or a smaller loan amount.

Why is DSCR Important?

The debt-service coverage ratio is important for lenders and borrowers for various reasons.

Lenders benefit from DSCR because it helps them assess the risk of lending money. They want to ensure that they will receive their money back with interest. A high DSCR implies that the borrower is likely to repay the loan, whereas a low DSCR may indicate financial difficulty and an increased likelihood of default.

Borrowers’ Perspective:

Understanding their DSCR Loan is critical for financial planning. It tells them whether they can afford to take on more debt or need to change their budget or business plan to improve their financial situation.

Property Evaluation:

DSCR is a regularly used real estate metric for determining a property’s income-generating potential. Investors use it to analyze whether a property’s rental income is sufficient to cover mortgage payments and other obligations.

How To Improve Your DSCR

If your DSCR is lower than you’d like, you can do the following to increase it:

Boost Income:

Look for ways to boost your income, such as raising rent costs (for landlords), having better-paying work, or finding new sources of cash.

Reduce Debt:

Paying off existing debt or refinancing at a lower interest rate can minimize debt payments and improve your DSCR.

Cut Expenses:

Look for ways to reduce your spending so that you can pay off your debts faster. This could entail eliminating unneeded expenses or discovering more cost-effective ways to manage your organization.

Improve Property Performance:

Real estate investors can boost the property’s net operating income (NOI) by boosting rental income or lowering operating expenses.

How to calculate the debt service coverage ratio?

The debt service coverage ratio displays the amount of EBITDA (earnings before interest, taxes, depreciation, and amortization) a business produces for each dollar of interest and principal paid.

The following formula is usually used to compute the ratio, which is often referred to as the debt servicing ratio:

EBITDA

_______________________________

(INTEREST + PRINCIPAL**)

Calculating the debt service coverage ratio is easy, but it’s often miscalculated.

3 common mistakes in the calculation of debt service coverage ratios

Amount of principal repaid

Calculating the actual amount is one of the most common causes of errors. Actual payments are not shown on the income statement. Instead, balance sheets show only the amount owed on loans.

According to Sood, “calculating actual payments made in an accounting period requires some additional internal record keeping.”

The amounts can be especially confusing if a business has received new financing during the year. In this scenario, loan payments for different loans may be lumped together, making it difficult to determine the actual amount paid.

To arrive at an accurate calculation, Sood recommends requesting a separate payment schedule for each of your company’s loans and using those statements to estimate the actual amount.

Capital lease expenses

Whether or not to include capital leasing expenses in the computation is a second point of confusion. An asset is leased for a long time under a capital lease and is treated as an asset purchase for accounting reasons.

For instance, a company may agree to a three-year lease to rent a forklift, with a five-year useful life and the option to buy the equipment at fair value at the end of the lease.

Additional accounting requirements apply to record these kinds of leases as the lessor has effectively determined the asset’s economic value as though it were a purchase.

While some analysts include capital leasing charges in the loan service coverage ratio, several lenders do not.

EBITDA vs EBIT

The debt payment coverage ratio can also be confusing when determining whether to utilize EBITDA or EBIT (earnings before interest and taxes). Both can be utilized, although Sood favors EBITDA because of its rapid cash flow approximation.

It’s important to note that incorporating EBITDA into an organization’s income statement can be a challenge, as it’s not a statistic recognized by the Generally Accepted Accounting Principles (GAAP). This could lead to potential misunderstandings. However, EBITDA can still be computed using the income statement’s numbers, as shown in the equation:

EBITDA = NET PROFIT + INTEREST + TAXES + DEPRECIATION AND AMORTIZATION

Check with your accountant

Ask your banking or investment partners what formula they require to see to ensure you utilize the correct components when calculating your debt service coverage ratio.

You can also determine the debt service coverage ratio in your financial projections using estimated numbers.

Many business owners see this and say, “Oh, that’s just bookkeeping.” It goes beyond bookkeeping and involves protecting their business’s financial stability going forward.

What is the debt service coverage ratio used for?

The debt service coverage ratio is typically employed for the following three objectives:

Loans:

The ratio is a crucial indicator of lender use of a company’s capacity to make interest and principal payments on time.

Investment

Buyers, investors, and shareholders use the ratio to assess a company’s dividend prospects and overall financial health. Sood says, “It shows how much money is left over for shareholders or investors.”

Strategy development

The ratio is a valuable tool for entrepreneurs to assess their potential for expansion and further funding. “I won’t have any money left over to reinvest in the company if all of it is going toward paying off debt,” Sood claims.

When preparing financial estimates for a significant investment or as part of strategic planning, it is a good idea to compute the ratio. Sood states, “That’s one of the key values of this indicator.

” It assists you in determining whether your health will continue to be optimal. If not, you had better go back and decide how to make it work to avoid breaking any.

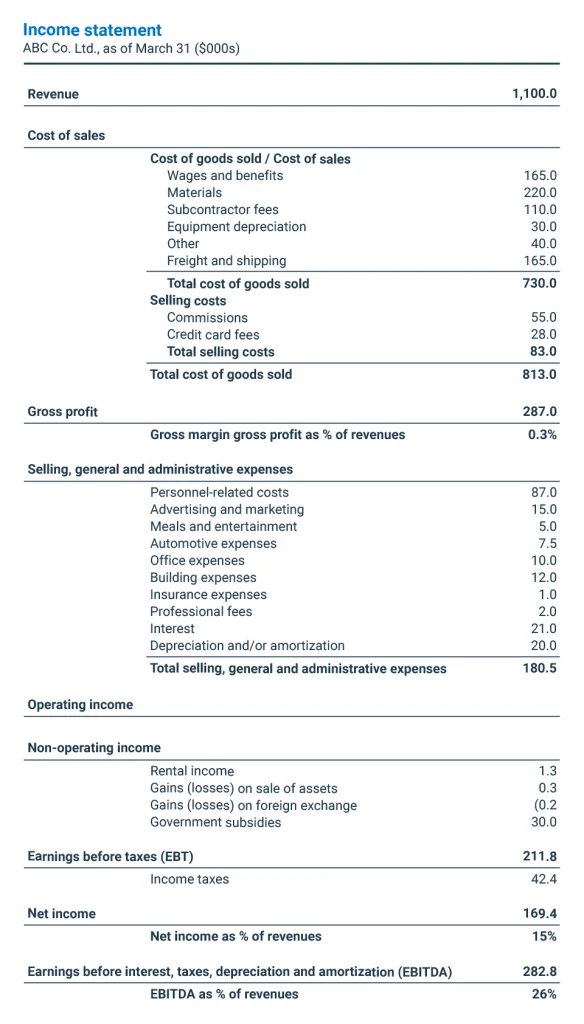

Example of the debt service coverage ratio

By examining ABC Co.’s income statement, provided below, we can observe that the business generated $21,000 in interest payments and had an EBITDA of $282,800 for the year.

A principal repayment of $49,700 would result in a total debt service of $70,700 and a debt service coverage ratio of 4, as principal repayments usually are not shown on an income statement.

EBITDA(INTEREST + PRINCIPAL**)

$282,800

______________________________

($21,000 + $49,700) = $70,700

= 4 TIMES

What is the good/bad debt service coverage ratio?

Generally speaking, a ratio of two or greater is considered healthy. If you’re at 1, all of your earned EBITDA goes directly toward debt, according to Sood.

However, Sood warns that lenders and other partners may have varying opinions on healthy or dangerous behavior.

These stakeholders are also aware that exceptional circumstances may transiently impact a company’s ratio. For instance, it might have undertaken a sizable expenditure when anticipated sales growth still needed to be fully translated into increased profits.

According to Sood, “The number is informational.” “It encourages more conversation.”

What is the debt service coverage ratio used by the banks?

When reviewing a loan request, lenders usually consider a company’s debt service coverage ratio in addition to several other indicators of its financial stability and debt capacity.

“We make our assessment after considering several indicators,” Sood states. The customer might excel in another area, yet this percentage might be entirely off. It’s necessary to comprehend the broader background of the business.

A bank may additionally request ratio figures from a loan recipient at various points during the loan’s term to determine whether the business continues to operate profitably.

These additional measures are frequently assessed in conjunction with the debt service coverage ratio:

DEBT

________________________

SHAREHOLDERS’ EQUITY

DEBT

_____________________________

TOTAL ASSETS

What is the debt service coverage ratio for real estate?

Real estate purchases:

If the property generates extra revenue for your business, purchasing real estate may impact your company’s debt payments and debt service coverage ratio.

Financing

Your company’s capacity to secure real estate finance may be impacted if it has a low debt service coverage ratio.

Fixed charge coverage ratio versus debt service coverage ratio

A variation of the debt service coverage ratio called the fixed-charge coverage ratio includes capital leasing expenses as part of the loan repayment.

What is your analysis of the debt service coverage ratio?

Sood suggests that organizations evaluate their debt service coverage ratio on an annual basis to assess their financial standing and compare it to previous years. As previously stated, a closer examination might be necessary if the ratio is less than 2.

She explains, “You can be reassured if you see it’s going up.” “If you notice a decline, that’s a chance to investigate the cause and devise a strategy to improve that ratio.”

Interest coverage ratio versus debt service coverage ratio

A standard indicator of a company’s financial health is the interest coverage ratio, often known as the time’s interest earned ratio. The interest coverage ratio is quite similar to the debt service coverage ratio; the primary distinction is that interest is the only type of debt included in the computation. The principal is omitted.

The following formula is used to get the interest coverage ratio:

EBITDA

__________________________

INTEREST